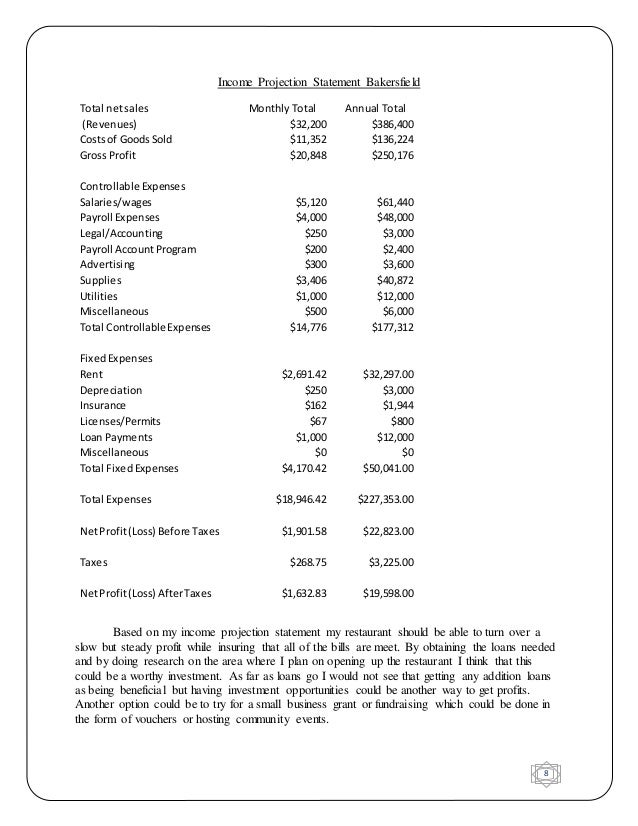

Whether you are already running a business, or making plans to start one up, financial planning is a vital part of ensuring your success. Not knowing your expected income and expenditure will make it difficult to plan, and hard to find investors.. This 5-Year Financial Plan spreadsheet will make it easy for you to calculate profit and loss, view your balance sheet and cash flow projections, as Dec 12, · The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders May 06, · In the financial section, provide a description of your funding requirements, your detailed financial statements, and a financial statement analysis. This part of the business plan is where you present the three main financial documents of any business: the balance sheet, the income statement, and the cash flow statement, or in the case of a

5-Year Financial Plan | Free Template for Excel

To meet short- and long-term financial goals, do financial section business plan, it is important to plan ahead. These resources will walk you through all aspects of financial planning, teaching you to control your income, expenses, and investments in a way that best works for you.

Financial plans help people live within their means, identify financial goals, and increase savings to help you reach those goals. To make a financial plan, you have to gather all relevant financial information, prioritize financial goals, and put a plan into action.

Create a budget, and when writing down your financial goals, make sure they are reachable and realistic. To make sure your plan is effective, you need to commit to following it. The very first step in the financial planning process is to take a deep dive into your finances.

This includes reviewing your monthly income, outstanding debts, bank account balances, and monthly fixed expenses. The seven steps of financial planning typically refer to financial planners; however, an individual can follow them too.

The first three steps are to understand and establish financial goals, determine your net worth, and estimate your income and expenses. Next, the steps include: reviewing your personal debt situation, allocating savings goals to reach, implementing the financial plan, and lastly, monitoring progress and continuing to update the financial plan.

Depending on your individual circumstances, such as age and income, taxes can have an impact. Say saving for retirement is a main goal for you, and your place of employment offers a k plan.

By choosing to enroll in the plan you will have a pathway to meet your goal, and tax advantages may be able to do financial section business plan you there even quicker. Also, when considering your net worth as part of the financial plan, a liability to factor in may be income taxes or taxes due on the profits of your investments.

A financial planner helps individuals reach their financial goals. In most cases, financial planners are certified in the practice and called Certified Financial Planners, or CFPs. CFPs have completed extensive training in financial planning and are held to strict ethical standards.

Financial health is a state of being in which a person, business, or financial institution measures their well-being by the condition of monetary assets and liabilities, such as debt and savings. Your tax liability is any amount you owe a taxing authority, such as the Internal Revenue Service.

There can be several components to your total tax liability with an agency, including unpaid taxes from prior years. Discretionary income is the income you have left over to spend, do financial section business plan, save, or invest after you pay taxes and for other essentials such as rent or mortgage, utilities, food, and credit card bills.

Discretionary income is less than both total income and disposable income because it's income you can use at your discretion. Your net worth is essentially a grand total of all your assets minus your liabilities. In other words, your net worth is the figure you get when you add up everything you own from the value of your home to the cash in your bank account and then subtract from that the value of all of your debts which may include a mortgage, car or student loans, or even credit card balances.

Estate planning is the systematic approach to organizing your personal and financial affairs to deal with the possibility of mental incapacity or death. Depending on your current family and financial situations, your foundational estate plan will include four or five essential legal estate planning documents.

Risk tolerance relates to the amount of market risk an investor can tolerate. In simple terms, it is how much you are willing to be unsure about and how much money you're willing to spend on this unknownin the face of possible gains.

Risk itself comes in many forms, such as the volatility of a certain stock, or full market ups and downs. Financial planners often use a person's risk tolerance to get a feel for what to expect from them as a new client, and vice versa. Adjusted gross income AGI is a tax term for your gross income minus tax deductions that are allowable whether or not you itemize deductions when you file your tax return.

It is the determiner for many of the deductions and credits you will receive, as well as any taxes you will owe when you file your tax return. A financial advisor is anyone who advises clients on money issues. Duties include: offering advice on how much money to save, making investment suggestions, offering tax advice, and buying and selling investments on behalf of a client. A k is an employer-sponsored retirement savings plan that lets employees set aside a portion of their wages for the future.

It also allows them to reap tax benefits in do financial section business plan process. A personal or household budget is a summary that do financial section business plan and tracks your income and expenses for a defined period, typically one month. A budget will show you how much money you expect to bring in, then compare that to your required expenses—such as rent and insurance—and your discretionary spendingsuch as entertainment or eating out.

It is a tool for achieving financial goals, do financial section business plan. Social Security is a federal program that issues benefits to retirees who paid into the program during their working years, people unable to work due to a physical or mental condition, spouses and children of beneficiaries, and surviving family members of beneficiaries. Social Security benefits are administered by the Social Security Administration.

Budgeting Financial Planning. Your Guide to Financial Planning. Deborah Fowles. Jeremy Vohwinkle. Miriam Caldwell. Frequently Asked Questions How do you make a financial plan?

Learn More: How a Financial Plan Can Help You. What is the first step in financial planning? Learn More: How to Build a Financial Safety Net for Financial Security. What are the seven steps of do financial section business plan planning? Learn More: The 7 Steps of Financial Planning.

How might taxes have an impact on your financial plan? Learn More: How To Do an Annual Financial Checkup. What is a financial planner? Learn More: How To Find a Financial Planner. Key Terms Financial Health Tax Liability Discretionary Income Net Worth Estate Planning Risk Tolerance Adjusted Gross Income AGI Financial Advisor k Budget Social Security.

Financial Health, do financial section business plan. Learn More, do financial section business plan. Tax Liability. Discretionary Income, do financial section business plan. Net Worth.

Estate Planning. Risk Tolerance. Adjusted Gross Income AGI. Financial Advisor. Social Security. Terri Williams. Dori Zinn. Shelley Elmblad. Anna Baluch. Explore Financial Planning All Saving Money Family Finances Estate Planning Financial Software. Financial Planning: Saving Money Family Finances Estate Planning Financial Software. More do financial section business plan Budgeting:.

Managing Your Debt.

Free cash flow (and revenue and profit) in the business plan

, time: 6:43How to Write a Business Plan That Will Get Approved for a Loan | Guidant

Whether you are already running a business, or making plans to start one up, financial planning is a vital part of ensuring your success. Not knowing your expected income and expenditure will make it difficult to plan, and hard to find investors.. This 5-Year Financial Plan spreadsheet will make it easy for you to calculate profit and loss, view your balance sheet and cash flow projections, as A financial plan is different from your financial statements. Instead of looking at what’s already happened, you make projections for the coming months, forecasting income and outlays. Your projections will act as an early warning system, helping you to plan for cash flow dips, identify financing needs and pinpoint the best timing for projects Dec 12, · The financial section of your business plan determines whether or not your business idea is viable and will be the focus of any investors who may be attracted to your business idea. The financial section is composed of four financial statements: the income statement, the cash flow projection, the balance sheet, and the statement of shareholders

No comments:

Post a Comment